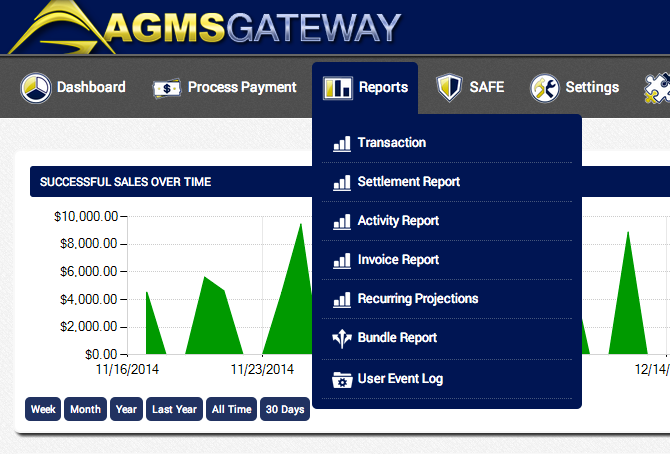

Reporting

Our reports give businesses real feedback. We offer reporting to review past transactions, check the status of a transaction, monitor employee activity, and see sales totals and transaction counts.

Available Report Types

| Report Type | Report Description |

|---|---|

| Transaction | View approved transactions. |

| Settlement | Quantity and volume of settled transactions. |

| Activity | View all approved and declined transactions. |

| Bundle | View processing results from using the Batch Upload tool. |

| Invoice | View open and closed invoices. |

| Recurring Projections | View predicted income for Recurring Billing. |

| User Event Log | A full history of user activity and events. |

Drill Down by Feature

Businesses can take advantage of feature reporting at no additional cost. Using these reports give businesses an insight on the AGMS Gateway features they use most. Recurring Projection reports provide a predicted income of all of all active customers set up with a recurring billing plan. Invoice reporting lets businesses know who has paid, and which customers have open invoices. If businesses wish to submit a batch to be processed using the Batch Upload tool, successful transactions from the uploaded bundle can be tracked in the Bundle report.

Reporting API

All reporting data can be found here. We’ve put together a robust Reporting API to provide all of the transaction details that are available to use. Custom fields created for collecting customer information can be tracked too.

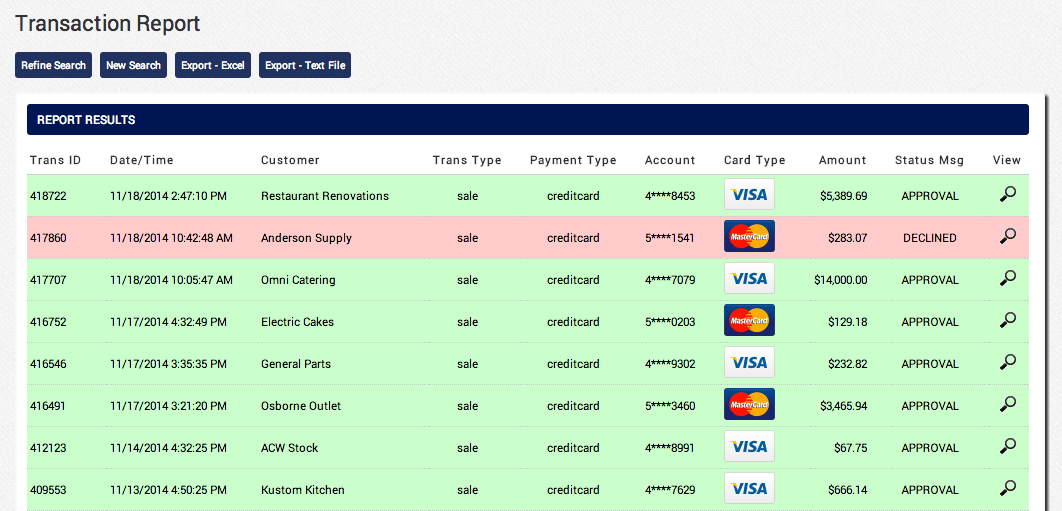

Transaction Reporting

A full history of transactions, including authorizations, captures, voids, and refunds can be seen here. Transaction Reports offer the ability to locate a specific transaciton and run a new authorization, sale, issue a credit, or even email a receipt without the customer's card being present. Additionally, the report can be used to determine if a transaction has been approved or declined.

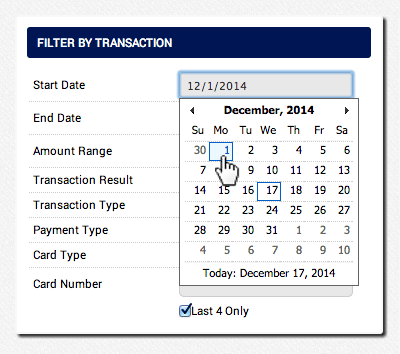

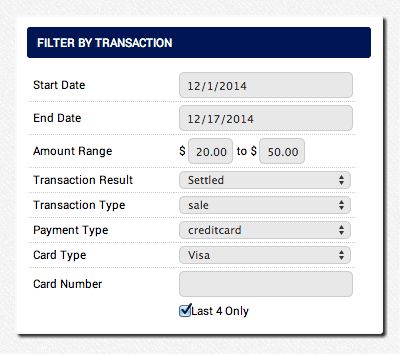

Transaction Report Filtering

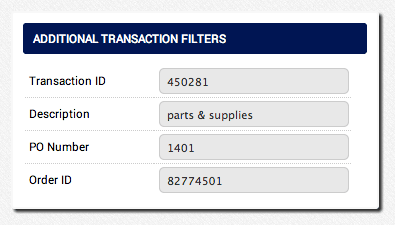

Individual and multiple filters can be applied to reports for targeting specific transactions. Transaction Reports allow for both transaction and customer filters to be applied. Here are some of the many filters that are available:

Filter by Transaction

| Value | Description |

|---|---|

| Start Date | The first date shown in the report. |

| End Date | The last date shown in the report. |

| Transaction Result | success, declined, failed, settled |

| Transaction Type | authorization, credit, void, capture, sale, refund |

| Payment Type | credit/debit card |

| Card Type | ACH/E-check, MasterCard, Visa, American Express, Discover |

| Card Number | A 16 digit credit/debit card number |

| Last 4 Only | The last 4 digits of the credit/debit card number |

| Transaction ID | A 6 digit identification number given to each approved transaction. |

| Description | A short description businesses can include with each transaction. |

| PO Number | A purchase order number designated by the business. |

| Order ID | An order identification number designated by the business. |

| Processor | Businesses with multiple processors can select which processor to view results for. |

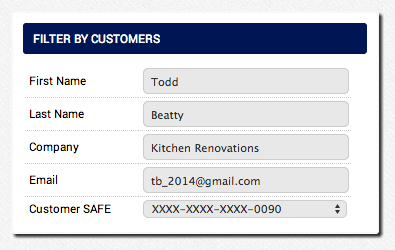

Filter by Customer

| Value | Description |

|---|---|

| First Name | The customer's first name. |

| Last Name | The customer's last name. |

| Company | A single customer or multiple customers from a company. |

| The customer's email address. | |

| Customer SAFE | A Customer SAFE record for a customer. |

Transaction Report Grouping

Once a report has been generated, transactions can be grouped for easily identifying results. Grouping transactions can be helpful to determine the smallest and largest transaction over a specified time frame. Here are the options for grouping:

| Column | Description |

|---|---|

| Date/Time | The date and time to organize results, listed in ascending order by default. |

| Transaction Type | authorization, credit, void, capture, sale, refund |

| Payment Type | credit/debit card |

| Card Type | ACH/E-check, MasterCard, Visa, American Express, Discover |

| Amount | Transaction amounts listed in ascending order by default. |

| Status Msg | approval or declined |

Running a Transaction Report

- Select a starting and ending date for the report

- Apply transaction filters to narrow the report results

- Apple additional transaction filters to target a specific transaction

- Apply customer filters to target a specific customer or company

- Click Search to generate the transaction report

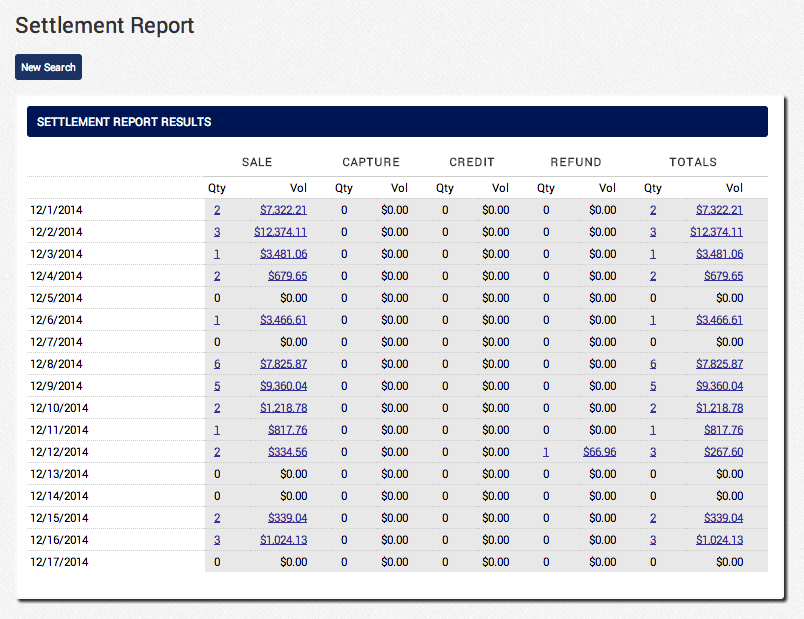

Settlement Report

The results of a Settlement Report show the quantity and volume for approved sales, captures, credits, and refunds that were settled in a specified date range. All transaction quantities and volumes settled are calculated into the total, which shows businesses how many approved transactions and how much revenue was generated in a specific date range. Settlement Reports are useful for identifying a business's average transaction amount, by using the volume to divide by the quantity of transactions.

Settlement Report Filtering

Specifying a starting and ending date range to generate the report puts businesses in control by allowing them to determine the scope of their settled transactions. We offer the ability to filter the report further by card type, such as ACH/E-check, MasterCard, Visa, American Express, or Discover, to show only the quantity and volume of a specified card type that was settled during the specified date range.

Settlement Report Grouping

Report results of quantities, volumes, and the total of both can be grouped by days, weeks, months, or card type. This allows businesses to see important data like how many refunds and how much refunded volume was lost over the past week, or how many sales and how much volume was generated over a busy day.

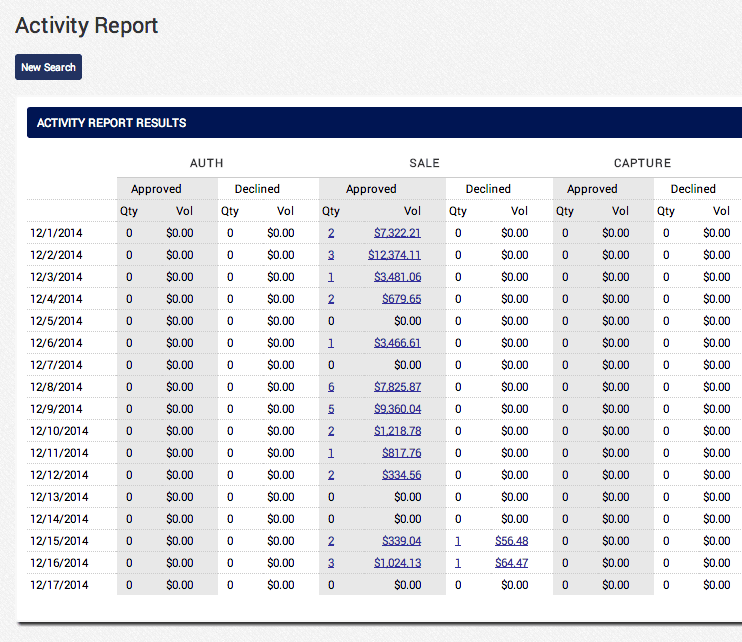

Activity Report

Activity Reports allow businesses to view both approved and declined transactions for all transaction types. Everything from authorizations, captures, sales, credits, refunds, voids, and even adjustments are shown. Each transaction type shows the quantity and volume for approved and declined transactions. Approved transactions are calculated together to provide businesses with a gross total of all transactions and the volume generated from these transactions.

Activity Report Filtering

Transaction activity can be filtered by card type to only show transactions for ACH/E-check, MasterCard, Visa, American Express, or Discover. Specifying a date range gives businesses the ability to determine the scrope for viewing all of their transaction activity.

Activity Report Grouping

Transaction activity can be grouped by the business's preference. Businesses have the ability to group transaction activity into days, weeks, month, or even card type.

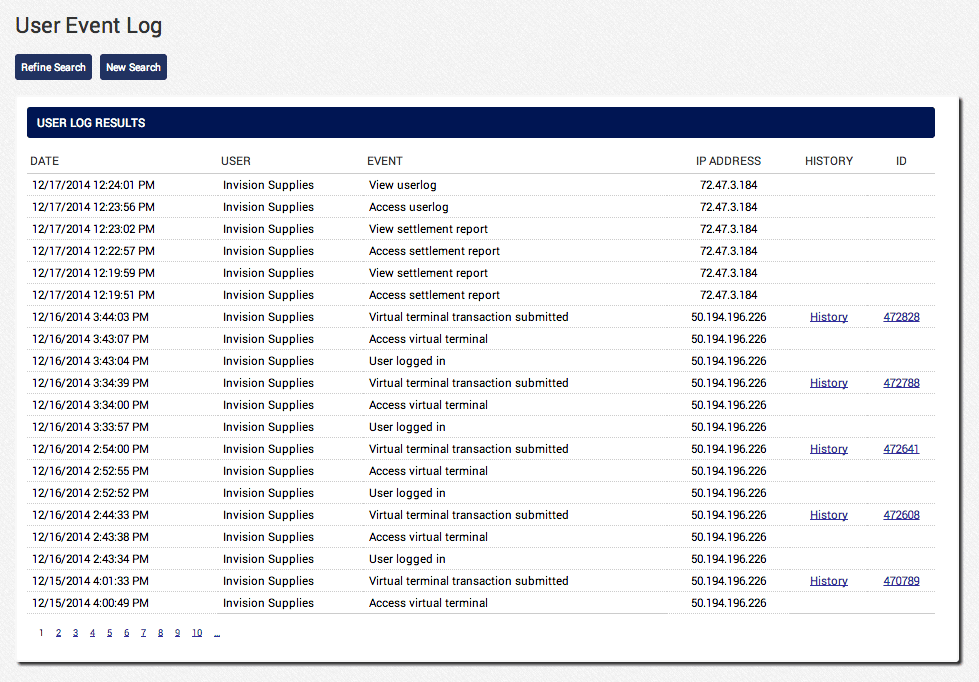

User Event Reporting

Businesses can use the User Event Log to track their employees' events, such as running reports, logging in to the AGMS Gateway, creating a new Customer SAFE record, when reports are viewed, who ran a transaction, and even which areas of the AGMS Gateway that an employee accessed. The User Event Log shows all user events that occurred during a specified date range and the computers that the events occurred on.

User Event Filtering

User events can be filtered by an IP Address, so identifying which computer events took place on can be targeted. If no IP Address is specified, all user events across all computers will show in the results. The date range for user events can be specified as well to narrow the scope of the report results.

User Event Grouping

Events can be grouped to target specific user activity. Businesses have the ability to group user events by a user, date, the type of event that occurred, the computer in which events occurred on, a history of the action that took place for an event, and even an identification number. The ID number can be used to access transaction details for a transaction event, while the history shows the action taken place for a specific event.